Congress’s 2021 “Corporate Transparency Act” requires certain types of U.S. and foreign entities to report information beginning January 1, 2024, about the entity’s beneficial owners to the United States Department of the Treasury’s Financial Crimes Enforcement Network, commonly known as FinCEN.

The United States Department of the Treasury’s Financial Crimes Enforcement Network, commonly known as FinCEN, which is responsible for safeguarding the U.S. financial system from illicit use, will start collecting and disclosing beneficial ownership information to certain authorized government authorities, financial institutions, and other authorized users beginning January 1, 2024.

Congress, under the 2021 “Corporate Transparency Act” created certain beneficial ownership reporting requirements which obligate entities to disclose information about their beneficial owners—the individuals who directly or indirectly own or control companies. The Corporate Transparency Act is part of the Anti-Money Laundering Act of 2020.

A reporting company created or registered to do business before January 1, 2024, will have until January 1, 2025, to file its initial beneficial ownership information report.

A reporting company created or registered on or after January 1, 2024, will have 30 days to file its initial beneficial ownership information report. This 30-day deadline runs from the time the company receives actual notice that its creation or registration is effective, or after a secretary of state or similar office first provides public notice of its creation or registration, whichever is earlier.

Who has to make a beneficial owner information report?

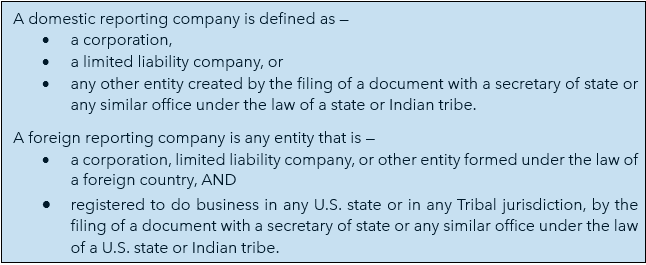

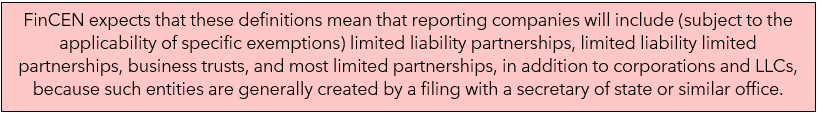

Certain companies — referred to as “reporting companies” — will be required to report their beneficial ownership information to FinCEN. There are two types of reporting companies — domestic reporting companies and foreign reporting companies.

If you had to file a document with a state or Indian Tribal-level office such as a secretary of state to create your company, or to register it to do business if it is a foreign company, then your company is a reporting company, unless an exemption applies.

For the definitions of both domestic and foreign reporting companies, a “state” means any state of the United States, the District of Columbia, the Commonwealth of Puerto Rico, the Commonwealth of the Northern Mariana Islands, American Samoa, Guam, the U.S. Virgin Islands, and any other commonwealth, territory, or possession of the United States.

Are there exemptions from the reporting requirement?

Yes. The Corporate Transparency Act exempts 23 types of entities from the beneficial ownership information reporting requirement. Below is a list of the types of entities that are exempt —

- Certain types of securities reporting issuers.

- A U.S. governmental authority.

- Certain types of banks.

- Federal or state credit unions as defined in section 101 of the Federal Credit Union Act.

- A bank holding company as defined in section 2 of the Bank Holding Company Act of 1956, or any savings and loan holding company as defined in section 10(a) of the Home Owners’ Loan Act.

- Certain types of money transmitting or money services businesses.

- Any broker or dealer, as defined in section 3 of the Securities Exchange Act of 1934, that is registered under section 15 of that Act (15 U.S.C. 78o).

- Securities exchanges or clearing agencies as defined in section 3 of the Securities Exchange Act of 1934, and that is registered under sections 6 or 17A of that Act.

- Certain other types of entities registered with the Securities and Exchange Commission under the Securities Exchange Act of 1934.

- Certain types of investment companies as defined in section 3 of the Investment Company Act of 1940, or investment advisers as defined in section 202 of the Investment Advisers Act of 1940.

- Certain types of venture capital fund advisers.

- Insurance companies defined in section 2 of the Investment Company Act of 1940.

- State-licensed insurance producers with an operating presence at a physical office within the United States, and authorized by a State, and subject to supervision by a State’s insurance commissioner or a similar official or agency.

- Commodity Exchange Act registered entities.

- Any public accounting firm registered in accordance with section 102 of the Sarbanes-Oxley Act of 2002.

- Certain types of regulated public utilities.

- Any financial market utility designated by the Financial Stability Oversight Council under section 804 of the Payment, Clearing, and Settlement Supervision Act of 2010.

- Certain pooled investment vehicles.

- Certain types of tax-exempt entities.

- Entities assisting certain types of tax-exempt entities.

- Large operating companies with at least 20 full-time employees, more than $5,000,000 in gross receipts or sales, and an operating presence at a physical office within the United States.

- The subsidiaries of certain exempt entities.

- Certain types of inactive entities that were in existence on or before January 1, 2020, the date the Corporate Transparency Act was enacted.

Many of these exempt entities are already regulated by federal and/or state government, and many already disclose their beneficial ownership information to a governmental authority.

Additional information about the entities that are exempt can be found in the Beneficial Ownership Information Reporting Regulations at 31 CFR § 1010.380(c)(2). You should consult the text of the regulations, which include specific criteria for the exemptions, before concluding that an entity qualifies for an exemption, with an attorney or other legal advisor to determine if your entity may qualify for an exemption.

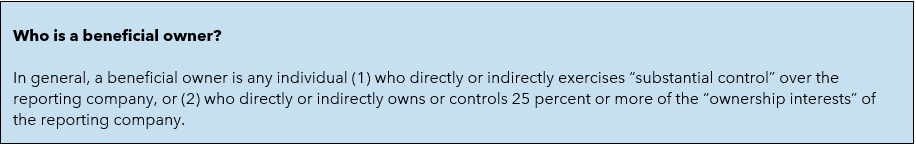

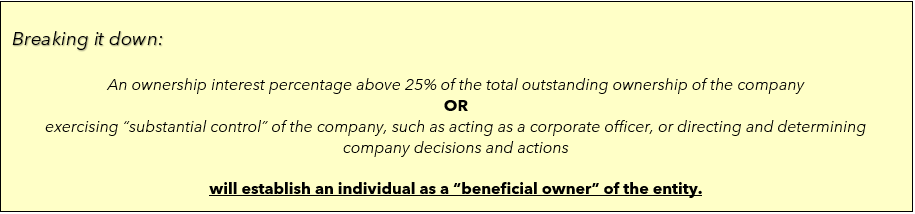

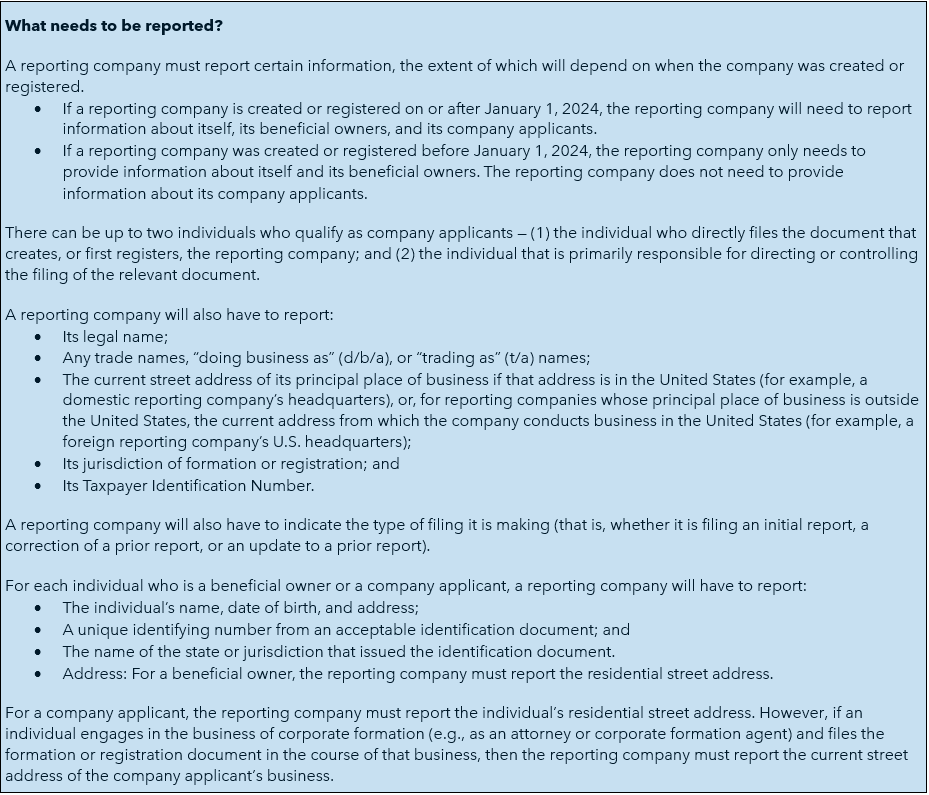

Whether an individual has “substantial control” over a reporting company depends on the power they may exercise over a reporting company.

For example, an individual will have substantial control of a reporting company if they direct, determine, or exercise substantial influence over important decisions the reporting company makes. In addition, any senior officer is deemed to have substantial control over a reporting company. The term “senior officer” means any individual holding the position or exercising the authority of a president, chief financial officer, general counsel, chief executive officer, chief operating officer, or any other officer, regardless of official title, who performs a similar function.

Other rights or responsibilities may also constitute substantial control. Additional information about the definition of substantial control and who qualifies as exercising substantial control can be found in the Beneficial Ownership Information Reporting Regulations at 31 CFR §1010.380(d)(1).

“Ownership interests” generally refer to arrangements that establish ownership rights in the reporting company, including simple shares of stock as well as more complex instruments. Additional information about ownership interests, including indirect ownership, can be found in the Beneficial Ownership Information Reporting Regulations at 31 CFR §1010.380(d)(2).

For example:

(1) The reporting company is a limited liability company (LLC). You are the sole owner and president of the company and make important decisions for the company. No one else owns or controls ownership interests in your company or exercises substantial control over your company.

You are a beneficial owner of the reporting company in two different ways, assuming no other facts. First, you exercise substantial control over the company because you are a senior officer of the company (the president) and because you make important decisions for the company. Second, you are also a beneficial owner because you own 25 percent or more of the reporting company’s ownership interests.

(2) The reporting company is a corporation. The company’s total outstanding ownership interests are shares of stock. Three people (Individuals A, B, and C) own 50 percent, 40 percent, and 10 percent of the stock, respectively, and one other person (Individual D) acts as the President for the company, but does not own any stock.

Assuming there are no other facts, Individuals A, B, and D are all beneficial owners of the company and their information must be reported. Individual C is not a beneficial owner.

Individual A owns 50 percent of the company’s stock and therefore is a beneficial owner because they own 25 percent or more of the company’s ownership interests. Individual B owns 40 percent of the company’s stock and therefore is a beneficial owner because they own 25 percent or more of the company’s ownership interests. Individual C is not a company officer and does not exercise any substantial control over the company. Further, Individual C only owns 10 percent of company stock, which is less than the 25 percent or greater ownership interest in determining beneficial ownership. Individual C is therefore not a beneficial owner of the company. Individual D is president of the company and is therefore a beneficial owner. As a senior officer of the company, Individual D exercises substantial control, regardless of whether the individual owns or controls 25 percent or more of the company’s ownership interests.

How do you file a company’s beneficial ownership information report?

If you are required to report your company’s beneficial ownership information to FinCEN, you will do so electronically through a secure filing system available via FinCEN’s website. This system is currently being developed and will be available before your report must be filed.

Who will be able to access reported beneficial ownership information and for what purposes?

The Corporate Transparency Act authorizes FinCEN to disclose beneficial ownership information in certain circumstances to six types of requesters:

- U.S. Federal agencies engaged in national security, intelligence, and law enforcement activities;

- State, local, and Tribal law enforcement agencies with court authorization;

- The U.S. Department of the Treasury;

- Financial institutions using beneficial ownership information to conduct legally required customer due diligence, provided the financial institutions have their customer consent to retrieve the information;

- Federal and state regulators assessing financial institutions for compliance with legally required customer due diligence obligations; and

- Foreign law enforcement agencies and certain other foreign authorities who submit qualifying requests for the information through a U.S. Federal agency.

Disclaimer:

The information provided in this newsletter does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available in this newsletter are for general informational purposes only. Information in this newsletter may not constitute the most up-to-date legal or other information. This newsletter may contain links to other third-party websites. Such links are only for the convenience of the reader, user, or browser; the authors of this newsletter do not recommend or endorse the contents of the third-party sites.

Readers of this newsletter should contact their attorney to obtain advice with respect to any particular legal matter. No reader, user, or browser of this newsletter should act or refrain from acting on the basis of information on this site without first seeking legal advice from counsel in the relevant jurisdiction. Only your individual attorney can provide assurances that the information contained herein – and your interpretation of it – is applicable or appropriate to your particular situation. Use of, and access to, this newsletter or any of the links or resources contained within this newsletter do not create an attorney-client relationship between the reader, user, or browser and newsletter authors, contributors, contributing law firms, or their respective employers or employees.

The views expressed at, or through, this newsletter are those of the individual authors writing in their individual capacities only. All liability with respect to actions taken or not taken based on the contents of this newsletter are hereby expressly disclaimed. The content on this posting is provided “as is;” no representations are made that the content is error-free.