The Washington State Legislature recently passed House Bill 1262 “Establishing a lump sum reporting system” requiring employers to report bonuses and lump-sum payments to the Washington State Division of Child Support (DCS) for any employees with a current Washington State Withholding Order that includes a payment amount for past-due child support.

The 2023 Washington State Legislature recently passed House Bill 1262 “Establishing a lump sum reporting system.” Effective July 23, 2023, employers who have received a “Withholding Order” on an employee’s wages for child support must report lump-sum payments made to such employee to the Washington State Division of Child Support (DCS).

House Bill 1262 requires an employer to notify the DCS before making any lump sum payment of $500 or more to a parent who is responsible for child support where the income withholding order “includes a provision for payment toward child support arrears.” An employer may report lump-sum payments less than $500 or undetermined amount lump-sum payments by providing notice to the DCS or the federal office of child support enforcement.

House Bill 1262 permits the employer to disburse one-half of the disposable earnings portion of the lump-sum payment to the responsible parent and prohibits the employer from disbursing the remaining amount of the lump sum payment prior to the expiration of a specified time period after notifying the DCS.

After receiving notice from an employer, House Bill 1262 requires the DCS to respond to the notifying employer within 14 days with either (1) instructions to release the lump sum payment for disbursement to the responsible parent or (2) instructions that specify the amount of the lump sum payment to be remitted to the DCS on behalf of the responsible parent.

If the payment is expected to be paid to the employee within the 14-day response time, employers must garnish and hold 50% of the payment until DCS responds or the 14 days expire. Employers can release the remaining 50% to the employee on the 15th day if no response is received from DCS. The legislation defines lump sum payment as “income other than a periodic recurring payment of earnings on regular paydays and does not include reimbursement for expenses.

The legislation defines lump sum payment as “income other than a periodic recurring payment of earnings on regular paydays and does not include reimbursement for expenses.

Lump sum payments include, but are not limited to:

- discretionary and nondiscretionary bonuses,

- cash service awards,

- commissions,

- performance bonuses,

- merit increases,

- safety awards,

- signing bonuses,

- moving and relocation incentive payments,

- vacation/holiday pay cash-out options,

- retroactive pay increases,

- termination pay, and

- severance pay.

Lump sum payment also includes workers’ compensation, insurance settlements, and personal injury settlements paid as replacement for wages owed.

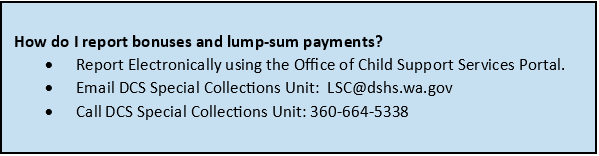

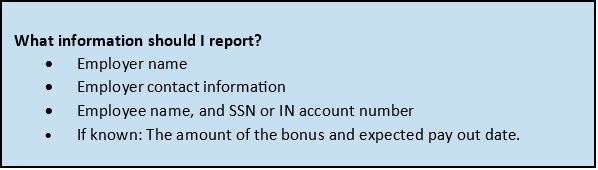

In order for DCS to provide the most accurate past-due child support balance, employers are encouraged to report lump sum payments as close to the payout date as possible.

Additionally, House Bill 1262 exempts an employer from liability for reporting or withholding and remitting a lump sum payment.

Employers in Washington who have or will receive income withholding orders on its employees for child support should review House Bill 1262 with their legal counsel and implement the necessary procedures to comply with the lump sum reporting to the DCS.